Accounting involves a process of collecting, recording, and reporting a business’s economic activities to users. It is often called the language of business because it uses a unique vocabulary to communicate information to decision-makers . To understand accounting, we first look at the basic forms of business organizations. The concepts and principles that provide the foundation for financial accounting are then discussed. With an emphasis on the corporate form of business organization, we will examine how we communicate to users of financial information using financial statements. Finally, we will review how financial transactions are analyzed and then reported on financial statements.

In this chapter, you will learn how to:

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

LO1 – Define accounting

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users. Users need information for decision making. Internal users of accounting information work for the organization and are responsible for planning, organizing, and operating the entity. The area of accounting known as managerial accounting serves the decision-making needs of internal users. External users do not work for the organization and include investors, creditors, labour unions, and customers. Financial accounting is the area of accounting that focuses on external reporting and meeting the needs of external users. This book addresses financial accounting. Managerial accounting is covered in other books.

LO2 – Identify and describe the forms of business organization.

An organization is a group of individuals who come together to pursue a common set of goals and objectives. There are two types of business organizations: business and non-business. A business organization sells products and/or services for profit. A non-business organization , such as a charity or hospital, exists to meet various societal needs and does not have profit as a goal. All businesses, regardless of type, record, report, and, most importantly, use accounting information for making decisions.

This book focuses on business organizations. There are three common forms of business organizations — a proprietorship, a partnership, and a corporation.

A proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same entity. This means, for example, that from an income tax perspective, the profits of a proprietorship are taxed as part of the owner’s personal income tax return. Unlimited liability is another characteristic of a sole proprietorship meaning that if the business could not pay its debts, the owner would be responsible even if the business’s debts were greater than the owner’s personal resources.

A partnership is a business owned by two or more individuals. Like the proprietorship, it is not a separate legal entity and its owners are typically subject to unlimited liability.

A corporation is a business owned by one or more owners. The owners are known as shareholders. A shareholder owns shares of the corporation. Shares 1 are units of ownership in a corporation. For example, if a corporation has 1,000 shares, there may be three shareholders where one has 700 shares, another has 200 shares, and the third has 100 shares. The number of shares held by a shareholder represents how much of the corporation they own. A corporation can have different types of shares; this topic is discussed in a later chapter. When there is only one type of share, it is usually called common shares .

A corporation’s shares can be privately held or available for public sale. A corporation that holds its shares privately and does not sell them publicly is known as a private enterprise (PE) . A corporation that sells its shares publicly, typically on a stock exchange, is called a publicly accountable enterprise (PAE) .

Unlike the proprietorship and partnership, a corporation is a separate legal entity. This means, for example, that from an income tax perspective, a corporation files its own tax return. The owners or shareholders of a corporation are not responsible for the corporation’s debts so have limited liability meaning that the most they can lose is what they invested in the corporation.

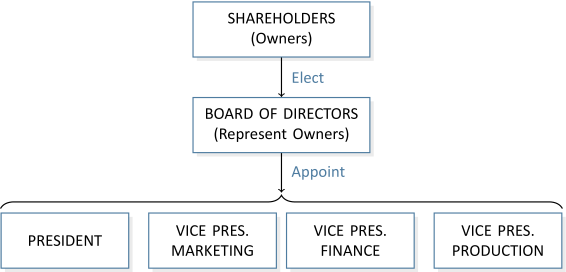

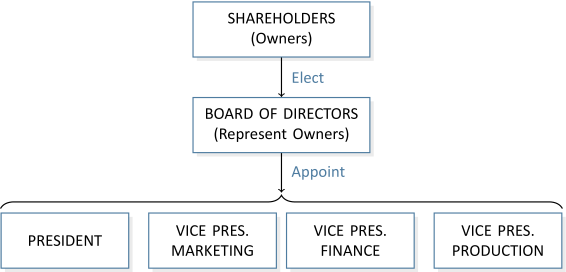

In larger corporations, there can be many shareholders. In these cases, shareholders do not manage a corporation but participate indirectly through the election of a Board of Directors . The Board of Directors does not participate in the day-to-day management of the corporation but delegates this responsibility to the officers of the corporation. An example of this delegation of responsibility is illustrated in Figure 1.1:

Shareholders usually meet annually to elect a Board of Directors. The Board of Directors meets regularly to review the corporation’s operations and to set policies for future operations. Unlike shareholders, directors can be held personally liable if a company fails.

This first activity provides you with the opportunity to self-assess how well you know the different types of business organizations.

Instructions: Identify properties of different types of business organizations. In all cases, incorrect entries will be shaded red. Correct entries will be shaded green. Note – this is not a graded activity.

LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP)

The goal of accounting is to ensure information provided to decision-makers is useful. To be useful, information must be relevant and faithfully represent a business’s economic activities. This requires ethics , beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles. These underlying accounting concepts or principles are known as Generally Accepted Accounting Principles (GAAP) .

GAAP in Canada, as well as in many other countries, is based on International Financial Reporting Standards (IFRS) for publicly accountable enterprises (PAE). IFRS are issued by the International Accounting Standards Board (IASB) . The IASB’s mandate is to promote the adoption of a single set of global accounting standards through a process of open and transparent discussions among corporations, financial institutions, and accounting firms around the world. Private enterprises (PE) in Canada are permitted to follow either IFRS or Accounting Standards for Private Enterprises (ASPE) , a set of less onerous GAAP-based standards developed by the Canadian Accounting Standards Board (AcSB). The AcSB is the body that governs accounting standards in Canada. The focus in this book will be on IFRS for PAEs.

Accounting practices are guided by GAAP which are comprised of qualitative characteristics and principles. As already stated, relevance and faithful representation are the primary qualitative characteristics. Comparability, verifiability, timeliness, and understandability are additional qualitative characteristics.

Information that possesses the quality of:

Table 1.1 lists the nine principles that support these qualitative characteristics.

| Accounting Principle | Explanation/Example |

| Business reporting entity |

Requires that each economic entity maintain separate records.

Consistency

Requires that a business use the same accounting policies and procedures from period to period.

Requires that each economic transaction be based on the actual original cost (also known as historical cost principle).

Requires that accounting information communicate sufficient information to allow users to make knowledgeable decisions.

Requires that financial transactions be reported in the period in which they occurred/were realized.

Requires a business to apply proper accounting only for items that would affect decisions made by users.

Requires that revenues be recorded when earned and expenses be recorded when incurred, which is not necessarily when cash is received (in the case of revenues) or paid (in the case of expenses).

Note: Some of the principles discussed above may be challenging to understand because related concepts have not yet been introduced. Therefore, most of these principles will be discussed again in more detail in a later chapter.

This Learning Activity provides you with the opportunity to self-assess how well you know key-terms from sections 1.1-1.3.

Instructions: Match each term with the correct definition. Note – this is not a graded activity.

LO4 – Identify, explain, and prepare the financial statements.

Recall that financial accounting focuses on communicating information to external users. That information is communicated using financial statements . There are four financial statements: the income statement, statement of changes in equity, balance sheet, and statement of cash flows. Each of these is introduced in the following sections using an example based on a fictitious corporate organization called Big Dog Carworks Corp.

An income statement communicates information about a business’s financial performance by summarizing revenues less expenses over a period of time. Revenues are created when a business provides products or services to a customer in exchange for assets. Assets are resources resulting from past events and from which future economic benefits are expected to result. Examples of assets include cash, equipment, and supplies. Assets will be discussed in more detail later in this chapter. Expenses are the assets that have been used up or the obligations incurred in the course of earning revenues. When revenues are greater than expenses, the difference is called net income or profit . When expenses are greater than revenue, a net loss results.

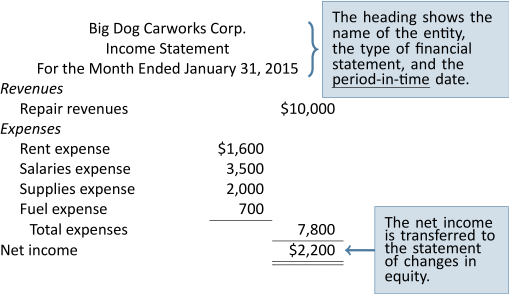

Consider the following income statement of Big Dog Carworks Corp. (BDCC). This business was started on January 1, 2015 by Bob “Big Dog” Baldwin in order to repair automobiles. All the shares of the corporation are owned by Bob.

At January 31, the income statement shows total revenues of $10,000 and various expenses totaling $7,800. Net income, the difference between $10,000 of revenues and $7,800 of expenses, equals $2,200:

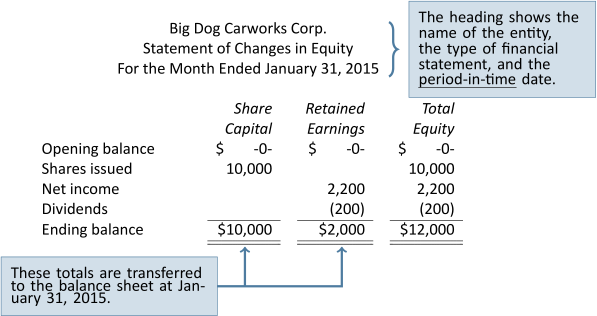

The statement of changes in equity provides information about how the balances in Share capital and Retained earnings changed during the period. Share capital is a heading in the shareholders’ equity section of the balance sheet and represents how much shareholders have invested. When shareholders buy shares, they are investing in the business. The number of shares they purchase will determine how much of the corporation they own. The type of ownership unit purchased by Big Dog’s shareholders is known as common shares. Other types of shares will be discussed in a later chapter. When a corporation sells its shares to shareholders, the corporation is said to be issuing shares to shareholders.

In the statement of changes in equity shown below, Share capital and Retained earnings balances at January 1 are zero because the corporation started the business on that date. During January, Share capital of $10,000 was issued to shareholders so the January 31 balance is $10,000.

Retained earnings is the sum of all net incomes earned by a corporation over its life, less any distributions of these net incomes to shareholders. Distributions of net income to shareholders are called dividends . Shareholders generally have the right to share in dividends according to the percentage of their ownership interest. To demonstrate the concept of retained earnings, recall that Big Dog has been in business for one month in which $2,200 of net income was reported. Additionally, $200 of dividends were distributed, so these are subtracted from retained earnings. Big Dog’s retained earnings were therefore $2,000 at January 31, 2015 as shown in the statement of changes in equity below:

To demonstrate how retained earnings would appear in the next accounting period, let’s assume that Big Dog reported a net income of $5,000 for February, 2015 and dividends of $1,000 were given to the shareholder. Based on this information, retained earnings at the end of February would be $6,000, calculated as the $2,000 January 31 balance plus the $5,000 February net income less the $1,000 February dividend. The balance in retained earnings continues to change over time because of additional net incomes/losses and dividends.

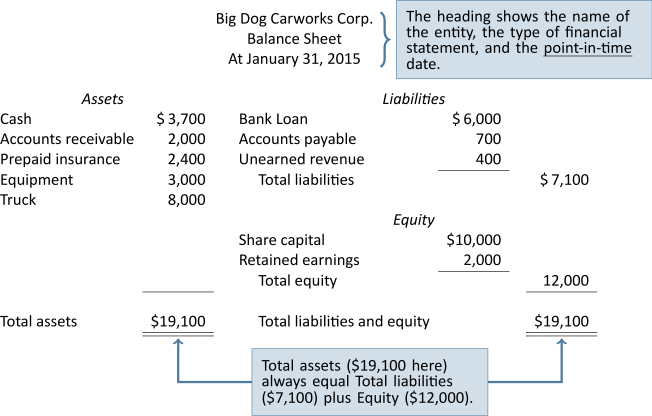

The balance sheet , or statement of financial position , shows a business’s assets, liabilities, and equity at a point in time. The balance sheet of Big Dog Carworks Corp. at January 31, 2015 is shown below:

Assets are economic resources that provide future benefits to the business. Examples include cash, accounts receivable, prepaid expenses, equipment, and trucks. Cash is coins and currency, usually held in a bank account, and is a financial resource with future benefit because of its purchasing power. Accounts receivable represent amounts to be collected in cash in the future for goods sold or services provided to customers on credit. Prepaid expenses are assets that are paid in cash in advance and have benefits that apply over future periods. For example, a one-year insurance policy purchased for cash on January 1, 2015 will provide a benefit until December 31, 2015 so is a prepaid asset. The equipment and truck were purchased on January 1, 2015 and will provide benefits for 2015 and beyond so are assets.

A liability is an obligation to pay an asset in the future. For example, Big Dog’s bank loan represents an obligation to repay cash in the future to the bank. Accounts payable are obligations to pay a creditor for goods purchased or services rendered. A creditor owns the right to receive payment from an individual or business. Unearned revenue represents an advance payment of cash from a customer for Big Dog’s services or products to be provided in the future. For example, Big Dog collected cash from a customer in advance for a repair to be done in the future.

Equity represents the net assets owned by the owners (the shareholders). Net assets are assets minus liabilities. For example, in Big Dog’s January 31 balance sheet, net assets are $12,000, calculated as total assets of $19,100 minus total liabilities of $7,100. This means that although there are $19,100 of assets, only $12,000 are owned by the shareholders and the balance, $7,100, are financed by debt. Notice that net assets and total equity are the same value; both are $12,000. Equity consists of share capital and retained earnings. Share capital represents how much the shareholders have invested in the business. Retained earnings is the sum of all net incomes earned by a corporation over its life, less any dividends distributed to shareholders.

In summary, the balance sheet is represented by the equation: Assets = Liabilities + Equity. Assets are the investments held by a business. The liabilities and equity explain how the assets have been financed, or funded. Assets can be financed through liabilities, also known as debt , or equity. Equity represents amounts that are owned by the owners, the shareholders, and consists of share capital and retained earnings. Investments made by shareholders, namely share capital, are used to finance assets and/or pay down liabilities. Additionally, retained earnings, comprised of net income less any dividends, also represent a source of financing.

Cash is an asset reported on the balance sheet. Ensuring there is sufficient cash to pay expenses and liabilities as they come due is a critical business activity. The statement of cash flows (SCF) explains how the balance in cash changed over a period of time by detailing the sources (inflows) and uses (outflows) of cash by type of activity: operating, investing, and financing, as these are the three types of activities a business engages in. Operating activities are the day-to-day processes involved in selling products and/or services to generate net income. Examples of operating activities include the purchase and use of supplies, paying employees, fuelling equipment, and renting space for the business. Investing activities are the buying of assets needed to generate revenues. For example, when an airline purchases airplanes, it is investing in assets required to help it generate revenue. Financing activities are the raising of money needed to invest in assets. Financing can involve issuing share capital (getting money from the owners known as shareholders) or borrowing. Figure 1.2 summarizes the interrelationships among the three types of business activities: