Anya Kartashova is a freelance writer and full-time traveler based in Salt Lake City. She has written about travel rewards and personal finance for FrugalTravelGuy, Fodor's, FlyerTalk, 10xTravel and Reward Expert. Her goal is to visit every country in the world by offsetting the cost with points and miles.

Assistant Assigning Editor Meghan CoyleMeghan Coyle started as a web producer and writer at NerdWallet in 2018. She covers travel rewards, including industry news, airline and hotel loyalty programs, and how to travel on points. She is based in Los Angeles.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

MORE LIKE THIS TravelTable of Contents

MORE LIKE THIS TravelNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account consumer complaint and customer satisfaction data.

Compare My Rates pros & consNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account consumer complaint and customer satisfaction data.

pros & consChubb is a property and casualty insurance company that operates in 54 countries and territories. Its executive offices are in France, Singapore, Switzerland, the United Kingdom and the United States.

Besides property and casualty insurance, the company also offers personal coverage and supplemental health insurance, life insurance and travel insurance. Chubb travel insurance is underwritten by ACE Property and Casualty Insurance Co.

Depending on what type of coverage you’re looking for, Chubb offers several different travel insurance options. It offers annual policies as well as single-trip plans for trips to domestic and international destinations.

Coverage ranges across:

Three single-trip travel insurance plan options are available: Travel Basics Plus, Travel Essentials Plus and Travel Choice Plus.

These are comprehensive travel insurance plans that include medical coverage as well as trip protections, such as trip delay, baggage delay and baggage loss.

Here's how coverage varies across the plans.

Travel Basics Plus

Travel Essentials Plus

Travel Choice Plus

100% of the trip cost (with a $100,000 limit).

100% of the trip cost (with a $100,000 limit).

100% of the trip cost (with a $100,000 limit).

100% of the trip cost (with a $100,000 limit).

150% of the trip cost (with a $150,000 limit).

150% of the trip cost (with a $150,000 limit).

Trip interruption – return air only

$100 per day, with a $500 maximum.

$150 per day, with a $750 maximum.

$200 per day, with a $1,000 maximum.

$750 (with a $50 deductible).

$15,000 (with a $50 deductible).

Emergency evacuation and repatriation

Accidental death and dismemberment

Preexisting medical conditions waiver

Must be purchased within 21 days after your initial trip payment.

Must be purchased within 21 days after your initial trip payment.

Must be purchased within 21 days after your initial trip payment.

All three plans offer an optional car rental collision coverage add-on that covers up to $35,000 (with a $250 deductible). This add-on includes damage caused by collision, vandalism or weather and does not include theft.

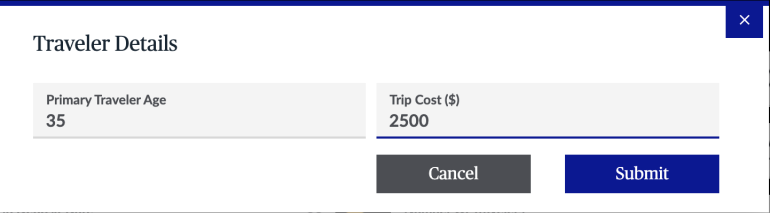

Below is how much a 35-year-old traveler from Utah would pay for travel insurance for a 10-day trip to Argentina valued at $2,500.

The least expensive of the options, the Travel Basics Plus plan will set you back $124.62. The Travel Essentials Plus policy comes in at $150.73 and provides more coverage. The most expensive plan, Travel Choice Plus, costs $215.13 and includes the most coverage with higher limits.

All plans include a $7 policy fee.

Chubb also offers multi-trip or annual travel insurance plans to those who take multiple trips per year. Three policies are available: Travel Basics 365, Travel Essentials 365 and Travel Choice 365.

Below are the coverage limits for annual travel insurance plans offered by Chubb.

Travel Basics 365

Travel Essentials 365

Travel Choice 365

$150 per day, with a $750 maximum (kicks in after five hours).

$150 per day, with a $1,000 maximum (kicks in after five hours).

$150 per day, with a $1,500 maximum (kicks in after five hours).

$500 (kicks in after three hours).

$1,000 (kicks in after three hours).

$150 per day, with a $300 maximum (kicks in after 12 hours).

$250 per day, with a $500 maximum (kicks in after 12 hours).

$250 per day, with a $1,000 maximum (kicks in after 12 hours).

Emergency evacuation and repatriation

Accidental death and dismemberment

Car rental collision damage waiver

$35,000 (with a $250 deductible).

$35,000 (with a $250 deductible).

Below is how much a 35-year-old traveler from Utah would pay for an annual travel insurance policy from Chubb.

The most affordable option of the three, the Travel Basics 365 plan, will set you back $141. The Travel Essentials 365 policy will set you back $233, and the Travel Choice 365 policy costs $449.

If you’re seeking coverage for one trip: Look into the single-trip travel insurance plans, such as Travel Basics Plus, Travel Essentials Plus and Travel Choice Plus.

If you’re traveling extensively: For travelers who take multiple trips per year or who are constantly on the road, an annual plan, such as Travel Basics 365, Travel Essentials 365 and Travel Choice 365, will provide a more economical solution.

If you hold a travel rewards credit card: Take a look at your card’s benefits guide and determine what kind of trip protections, if any, are offered by your credit card. Pick a travel insurance plan with perks that don’t overlap with what is already covered.

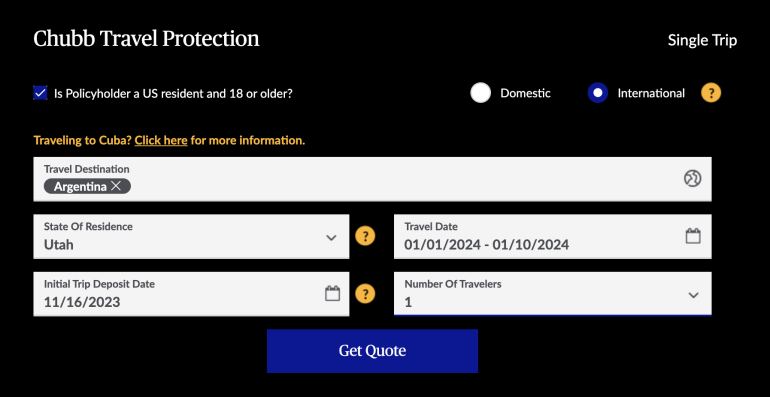

To get a quote from Chubb for an individual or family travel policy, start on it's website . Decide whether you need a single-trip plan or an annual plan, and click on “Get a quote.”

Select between a domestic or an international policy and confirm that you’re a U.S. resident and at least 18 years old by checking the respective box. Enter your travel destination, state of residence, travel dates, the initial trip deposit date and the number of travelers.

Then provide a couple of more details, such as the primary traveler’s age and the cost of the trip.

The quotes for each plan will be displayed on the next page.

For an annual policy, select your state of residence from the dropdown menu, pick a coverage start date, enter the traveler’s age and click “Get quote.”

Like most insurance providers, Chubb publishes a list of exclusions to its coverage. Below are some of the situations not covered by Chubb travel insurance:

Intentional self-inflicted injuries or suicide. Normal pregnancy or elective abortion. Participation in professional athletic events. Mountaineering. War, acts of war or participating in a civil disorder, riot or resurrection. Operating or learning to operate an aircraft. Being under the influence of drugs or narcotics. Traveling for the purpose of securing medical treatment. Traveling against a physician’s recommendation.If you look online, Chubb travel insurance reviews are mixed, but they also include car, home and business insurance, not the company’s travel insurance branch specifically.

In any case, before you purchase a plan, we recommend not only comparing prices but also reading policy terms to make sure you understand what's covered so your claim will be accepted should you need to file one.

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card No annual fee: Wells Fargo Autograph℠ Card Flat-rate travel rewards: Capital One Venture Rewards Credit Card Bonus travel rewards and high-end perks: Chase Sapphire Reserve® Luxury perks: The Platinum Card® from American Express Business travelers: Ink Business Preferred® Credit Card About the authorYou’re following Anya Kartashova

Visit your My NerdWallet Settings page to see all the writers you're following.

Anya is a freelance writer whose work has been published on FrugalTravelGuy, Fodor's, FlyerTalk, 10xTravel and Reward Expert. See full bio.

Cards for Travel Insurance from our Partners

on Chase's website

Chase Sapphire Reserve® NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rateEarn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

Intro offerEarn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

on Chase's website

Chase Sapphire Preferred® Card NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rate5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

Intro offerEarn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

on Chase's website

Southwest Rapid Rewards® Plus Credit Card NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rateEarn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

Intro offerEarn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

MORE LIKE THIS Travel

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105